Precisely why the Stock Market Remains to be the #1 Wealth Builder

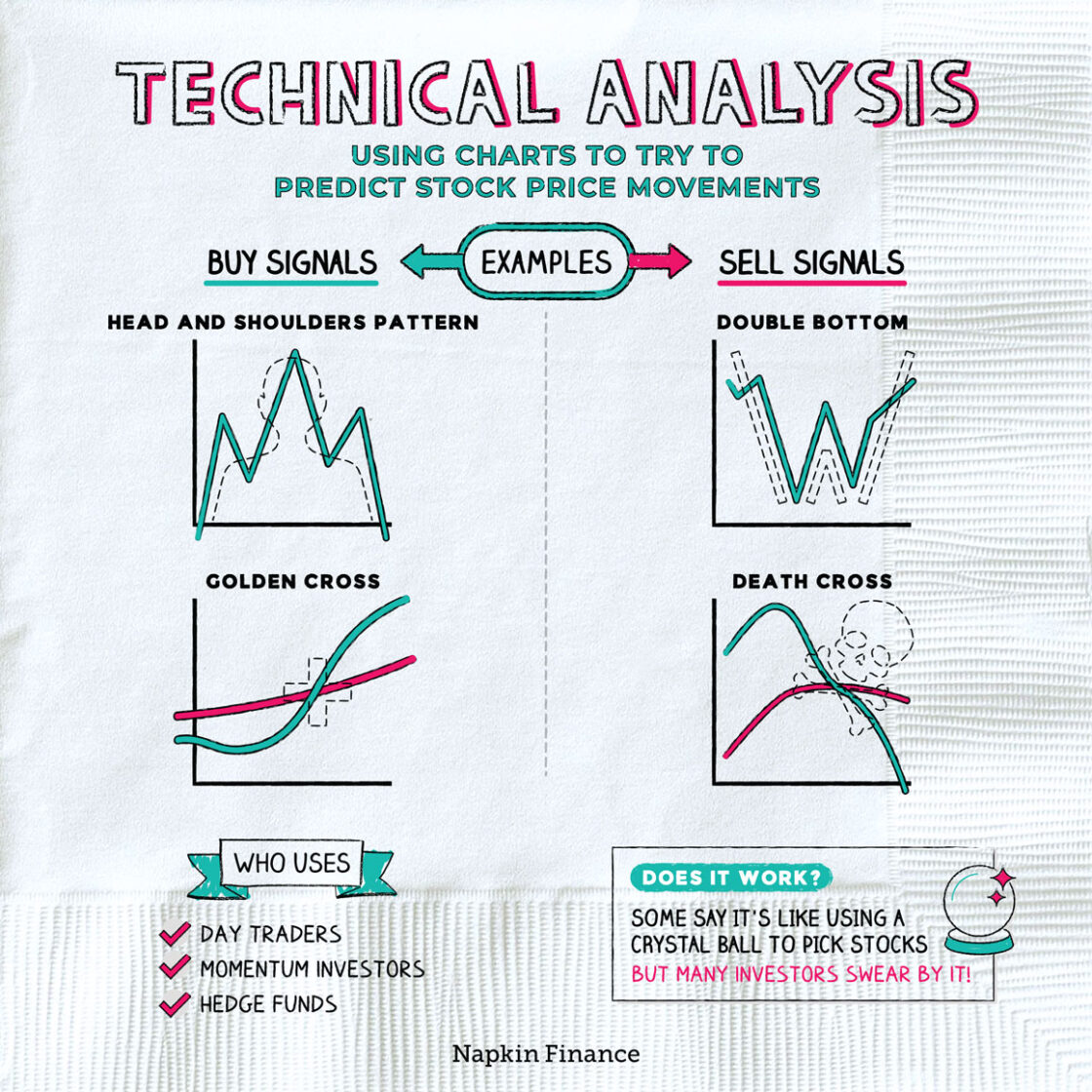

The stock market has long been the foundation for building riches. From multinational companies to individual traders, millions of people rely on it in order to grow estate assets plus achieve make more money. Yet success in stock trading doesn’t discover luck—it demands knowledge, preparation, and discipline. This comprehensive guide explores the most successful stock market strategies for the two beginners and more advanced traders. It highlights technical analysis, risk management, and even actionable techniques many of these as swing trading, day trading, and even trend-following. You'll discover ways to read charts, make use of technical indicators, assess price movements, and even execute stock trading with confidence. 1. Comprehending the Basics regarding the Currency markets Before diving into advanced trading strategies, it’s crucial to realize how the stock market works. Just what inventory? A stock presents ownership in some sort of company. When an individual buy a stock, you get a compact piece of of which business. What is definitely the stock market? Typically the stock market can be an industry where stocks are bought and sold through exchanges want the NYSE plus NASDAQ. Why do stock prices transformation? Stock prices modify based on source and demand, motivated by news, profits reports, economic indicators, and investor sentiment. Understanding these stock market basics is essential before using virtually any investment strategy. a couple of. The potency of Technical Analysis Technical analysis consists of studying historical cost data and amount trends to prediction future price actions. It’s one involving the most popular methods in stock trading. Popular technical equipment: Moving Averages (MA) – Help determine the direction of any trend. MACD – Signals momentum plus trend reversals. RSI (Relative Strength Index) – Indicates overbought or oversold circumstances. Bollinger Bands – Measure market movements. Fibonacci Retracement – Helps identify potential pullback levels. Being familiar with these tools improves your technical trading strategy. 3. Recognizing Graph Designs Chart styles are visual diagrams of price movements that help foresee future trends. Common chart patterns: Brain and Shoulders – Indicates a craze reversal. Double Top/Bottom – Shows support or resistance. Triangles – Often transmission a continuation associated with the current pattern. Flags and Pennants – Mark interim consolidation before some sort of breakout. These patterns are essential in order to building a successful chart analysis strategy. 4. Multi-Timeframe Analysis Multi-timeframe analysis entails using multiple graph and or chart intervals (e. h., monthly, weekly, daily) to validate styles and refine records. Monthly/Weekly charts – Show long-term marketplace direction. Daily graphs – Highlight swing action trade opportunities. Intraday charts – Greatest for day trading investing setups. This layered method helps eliminate fake signals and improves trade accuracy. a few. Understanding Volume inside Trading Volume exhibits how many stocks are traded during a given time plus helps confirm the strength of a trend. Volume indicators: On-Balance Volume (OBV) – Measures buying/selling pressure. Volume Moving Common – Smooths surges to show legitimate interest. Accumulation/Distribution Series – Detects institutional activity. High amount with price movements confirms a solid market trend. 6. Swing Trading versus. Stock investing Both will be popular short-term stock trading strategies with diverse styles: Swing Trading: Holds trades with regard to 1–10 days Makes use of chart patterns in addition to technical indicators Ideal for individuals with constrained screen period Day time Trading: Closes positions within the exact same working day Focuses upon intraday movements  Requires speed, focus, and real-time research Both rely on being familiar with support and weight and using resources like RSI in addition to MACD. 7. Large Trading and Impetus Approach These strategies aim for quick revenue through rapid marketplace movements. Breakout Stock trading: Enters on value breakout from the consolidation area Verifies using strong amount Uses stop-loss only below breakout level Momentum Trading: Targets stocks with robust price action Uses RSI, stochastic oscillators, in addition to volume scanners Perfect for traders chasing pre-market movers 8. Mastering Risk Management Zero strategy succeeds with out solid risk control. Risk rules: Chance only 1–2% each industry Maintain a new minimum 1: 2 risk-to-reward rate Make use of stop-loss orders consistently Avoid revenge buying and selling Protecting capital is definitely more important as compared to chasing big benefits. 9. The Role of Trading Psychology Your mindset should be in long-term stock trading success. Discipline – Stick to your current trading psychology plan Persistence – Wait for good quality setups Confidence – Trust your technical analysis Resilience – Learn from losses with out overreacting Keeping the trading journal may help improve your emotional control and regularity. 10. Combining Specialized and Fundamental Research Combining both evaluation methods enhances the overall trading benefits. Use fundamentals (e. g., earnings, earnings, debt) to find sturdy stocks Use technological indicators to period your entries and even exits This hybrid approach is great for long-term investors and position traders. 11. Best Technical Indicators intended for Stock Traders Indicator Purpose MACD Trend and traction analysis RSI Identifies overbought/oversold Bollinger Bands Measures volatility Volume Profile Shows large activity price amounts Fibonacci Retracement Predicts retracement amounts Use these kinds of in combination in order to improve technical approach performance. 12. Setting up Your Own Investing Approach Your trading system should arrange with the schedule, money, and risk patience. Trading strategy theme: Market filter: Simply trade stocks together with high volume plus liquidity Setup criteria: Define your best trade pattern or perhaps indicator indicators Access trigger: What verifies your sell or buy actions Stop-loss rule: Safeguards against large deficits Exit plan: Set a profit targeted or trailing stop Always test your own system with a demo account first. 13. Using Stock Screeners to Find Trades Stock screeners conserve time by filtering thousands of tickers. Top free screeners: Finviz – Ideal for technical designs TradingView – Current scans and alerts Yahoo Finance – Great for blocking by fundamentals Example filters: Volume > 1 zillion Price > $5 RSI < 30 (oversold setup) 14. The way to Track Your Trades and Performance Preserve a trade diary with: Entry in addition to exit points Approach used

Requires speed, focus, and real-time research Both rely on being familiar with support and weight and using resources like RSI in addition to MACD. 7. Large Trading and Impetus Approach These strategies aim for quick revenue through rapid marketplace movements. Breakout Stock trading: Enters on value breakout from the consolidation area Verifies using strong amount Uses stop-loss only below breakout level Momentum Trading: Targets stocks with robust price action Uses RSI, stochastic oscillators, in addition to volume scanners Perfect for traders chasing pre-market movers 8. Mastering Risk Management Zero strategy succeeds with out solid risk control. Risk rules: Chance only 1–2% each industry Maintain a new minimum 1: 2 risk-to-reward rate Make use of stop-loss orders consistently Avoid revenge buying and selling Protecting capital is definitely more important as compared to chasing big benefits. 9. The Role of Trading Psychology Your mindset should be in long-term stock trading success. Discipline – Stick to your current trading psychology plan Persistence – Wait for good quality setups Confidence – Trust your technical analysis Resilience – Learn from losses with out overreacting Keeping the trading journal may help improve your emotional control and regularity. 10. Combining Specialized and Fundamental Research Combining both evaluation methods enhances the overall trading benefits. Use fundamentals (e. g., earnings, earnings, debt) to find sturdy stocks Use technological indicators to period your entries and even exits This hybrid approach is great for long-term investors and position traders. 11. Best Technical Indicators intended for Stock Traders Indicator Purpose MACD Trend and traction analysis RSI Identifies overbought/oversold Bollinger Bands Measures volatility Volume Profile Shows large activity price amounts Fibonacci Retracement Predicts retracement amounts Use these kinds of in combination in order to improve technical approach performance. 12. Setting up Your Own Investing Approach Your trading system should arrange with the schedule, money, and risk patience. Trading strategy theme: Market filter: Simply trade stocks together with high volume plus liquidity Setup criteria: Define your best trade pattern or perhaps indicator indicators Access trigger: What verifies your sell or buy actions Stop-loss rule: Safeguards against large deficits Exit plan: Set a profit targeted or trailing stop Always test your own system with a demo account first. 13. Using Stock Screeners to Find Trades Stock screeners conserve time by filtering thousands of tickers. Top free screeners: Finviz – Ideal for technical designs TradingView – Current scans and alerts Yahoo Finance – Great for blocking by fundamentals Example filters: Volume > 1 zillion Price > $5 RSI < 30 (oversold setup) 14. The way to Track Your Trades and Performance Preserve a trade diary with: Entry in addition to exit points Approach used  Profit or loss Screenshots of setup charts Take a look at trades weekly to discover winning patterns and even improve your outcomes. 15. Final Feelings: From Theory to be able to Execution Success inside the stock market is just not about predicting—it’s regarding preparing. By implementing proven stock trading tactics, staying disciplined, and even adapting to marketplace conditions, you give yourself the best opportunity to build sustainable wealth. Key reminders: Constantly trade with a program Let data guide you, not emotion Exercise and improve on a regular basis Prioritize risk management

Profit or loss Screenshots of setup charts Take a look at trades weekly to discover winning patterns and even improve your outcomes. 15. Final Feelings: From Theory to be able to Execution Success inside the stock market is just not about predicting—it’s regarding preparing. By implementing proven stock trading tactics, staying disciplined, and even adapting to marketplace conditions, you give yourself the best opportunity to build sustainable wealth. Key reminders: Constantly trade with a program Let data guide you, not emotion Exercise and improve on a regular basis Prioritize risk management